Taiwan firms in mainland China turn ‘more cautious’ with investments as cuts and offshoring increase, survey finds

- Geopolitical tensions, coupled with a weakened and more uncertain business environment on the mainland, keep taking a toll on investor confidence among Taiwanese

- Analysts have also flagged that higher US tariffs on Chinese exports keep pushing manufacturers toward other Asian manufacturing hubs, including Vietnam

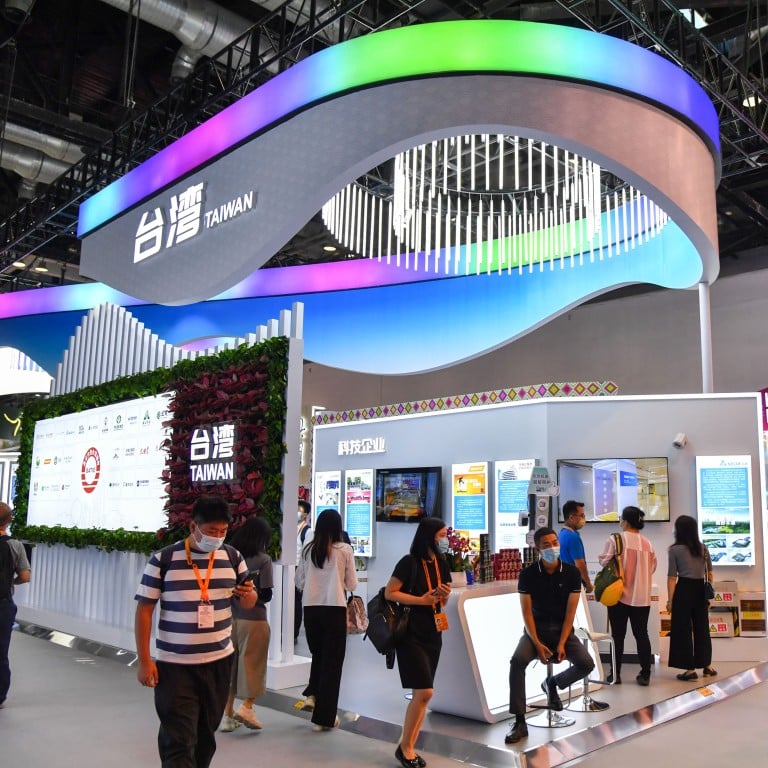

Taiwanese firms, a historical source of capital for mainland China, have grown extra cautious when it comes to expanding those investments, and many are also considering capacity cuts or offshoring as they seek safeguards against geopolitical risks.

About two-thirds of Taiwanese firms in mainland China plan to sustain their current levels of investment over the next three to five years, but the number planning to make cuts is twice that of those anticipating increases, according to a recent industry group survey.

The Taipei-based Chinese National Federation of Industries, an industrial association that represents most Taiwanese manufacturing businesses and comprises 158 separate trade organisations, said that 21.5 per cent of surveyed investors expected to cut back assets while 10.6 would add them. It also found that 41.6 per cent of respondents planned to reduce staffing, and 38.7 per cent were looking to reduce capacity.

“This shows that manufacturers are worried about market prospects and are becoming more cautious about investing in the mainland,” the federation said in a summary of the survey conducted last year.

As mainland China seeks more Taiwanese money, why aren’t more listening?

Meanwhile, hitches in the Chinese economy, concerns about any potential impacts from a military conflict, and the enduring impact of geopolitical tensions – including from the US-China trade war – are said to be underpinning the decisions of Taiwanese businesspeople with regard to the mainland.

China is trying to ease unemployment, control a housing crisis, and stimulate domestic consumption to inject more life into its economy.

Taiwanese investors have also watched the cost of business rise, and cross-strait political tensions have heated up over the past few years.

Beijing sees Taiwan as part of China to be reunited by force if necessary. Most countries, including the US, do not recognise Taiwan as an independent state, but Washington opposes any attempt to take the self-governed island by force and remains committed to supplying it with weapons.

For their part, investors have no interest in finding themselves caught in the crossfire. As a result, some Taiwan firms have funnelled more business toward the West in the midst of supply-chain decoupling that has resulted from the US-China trade war.

The Taiwan cabinet has said that approved investment in mainland China from 1991 to 2022 reached US$203.33 billion, covering 45,195 projects. But last year, those investments dipped to a 22-year low of US$3.04 billion.

Among survey respondents, 44.2 per cent planned to invest outside mainland China, and more than half of that total were looking to target Taiwan, while just over a third pointed to Vietnam.

Vietnam has been seen for the past decade as a “China-plus-one” alternative for multinational manufacturers.

And the fast-growing Southeast Asian country is prospering from a contentious US-China trade environment, S&P Global Market Intelligence’s former Asia-Pacific chief economist, Rajiv Biswas, said in an October commentary.

Higher US tariffs on Chinese exports have “driven manufacturers to switch production of manufacturing exports away from China and towards alternative manufacturing hubs in Asia”, including Vietnam, he said.

Goertek to open Vietnam factory as part of Apple’s supply chain diversification

However, just 10.1 per cent of surveyed investors said they were considering putting an end to their operations on the mainland.

“Taiwan needs to diversify its trade partners but does not need to give up mainland China as an important trade partner,” said Hu Jin-li, a professor with the Institute of Business and Management at National Yang Ming Chiao Tung University in Taipei.

Most Taiwanese firms in mainland China cluster near Shanghai and in the Pearl River Delta due to those regions’ advanced infrastructure, transport and human resources, Hu said.

Taiwanese began establishing factories on the mainland as far back as the 1980s for its cheap land and labour.

Ho contends that state-owned Chinese firms have spawned that overcapacity as they work to create an upstream-midstream-downstream domestic ecosystem through 2026.

“Petrochemical investors will do their best to take funds out of China, and I don’t mean just Taiwanese investors,” he said.

More than half of the survey respondents agreed that geopolitical conflicts had hurt their product orders and profits. They pointed to supply-chain shifts resulting from US-China frictions, falling confidence among their foreign customers, and economic woes in mainland China.

Cross-strait tensions escalated after Nancy Pelosi, then the US House speaker, defied repeated warnings from Beijing by visiting Taiwan. Her trip led to the deployment of a People’s Liberation Army destroyer and guided missile frigate in waters east of Taiwan. The US aircraft carrier USS Ronald Reagan and amphibious ship USS Tripoli were also reported to be operating near the island.

None of the Taiwanese investors are comfortable with their positions in China

Kent Chong, a partner with professional services firm PwC in Taipei, said Taiwanese companies have responded to the rise in tensions by re-evaluating their mainland exposure, particularly in the past year. PwC helps Taiwanese clients manage their wealth.

“There’s always talk about conflict,” Chong said, adding that, because of cross-strait politics, as well as bumps in the mainland Chinese economy, “none of the Taiwanese investors are comfortable with their positions in China”.

Seventy per cent of the survey respondents added that rising interest rates, plus sluggish demand in Europe and the US, had also hurt their profits and orders.

Meanwhile, the survey summary acknowledged that Taiwan was contending with its own issues.

Eyeing fix for talent shortage, Taiwan opens door wider for foreign graduates

Taiwan’s flagship technology sector alone is expected to experience “persistent talent shortages” this year, with 81 per cent of employers planning pay rises of 10 to 20 per cent to find people, said Kiera Lien, a marketing executive with the Robert Walters recruitment agency in Taipei.

More than 60 per cent of surveyed investors also said they would like government assistance in water and electricity supplies.

Government assistance should extend offshore, said Darson Chiu, a fellow with the Taiwan Institute of Economic Research.

“The Taiwan government should expand the coverage of free-trade agreements and assist companies in diversifying overseas investments,” Chiu said. “The dispute between the United States and China is a structural issue, and the government should help companies grasp structural trends.”