|

The Taiwanese Economy in May 2020

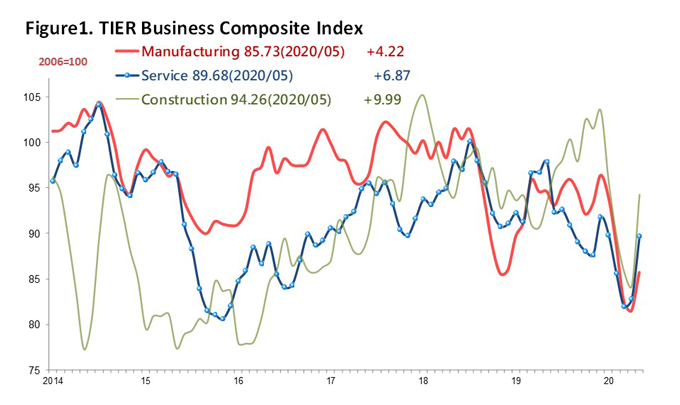

The United States and European economies have started to reopen and restart their economy looking for economic rebound. The impacts of COVID-19 seem to be managed by major economies with respect to strong desire to go back to business as usual. The recovery of global demand has helped to beef up all three composite indicators issued by the Taiwan Institute of Economic Research (TIER). The manufacturing, service and construction composite indicators all went up in May.

Taiwan's exports in May 2020 decreased by 1.98% compared with the same month of 2019 in spite of a strong market demand for ICT parts and components with respect to higher base effect. Regarding imports, Taiwan's imports in May 2020 decreased by 3.45% compared with imports in May of 2019 due to the continuously dipping prices of raw materials. On the cumulative basis, Taiwan's exports and imports from January 1 till May 31 of 2020 grew by 1.47% and 1.42% compared with the same period of previous year. The trade surplus during the period stood at US$ 16.51 billion or increased by 1.86% on the year-on-year basis.

Taiwan's consumer price index (CPI) decreased by 1.19% in May 2020 compared with the same month of previous year due to the still decreasing global crude oil prices. The core inflation rate excluding prices of the energy and food increased by 0.08% in May 2020. In addition, the wholesale price index (WPI) decreased by 11.60% in May 2020 on the year-on-year basis due to the fact that commodity prices dropped continuously. On the cumulative and year-on-year basis, Taiwan's CPI and WPI from January 1 till May 31 of 2020 drop by 0.11% and 7.57% respectively.

As for exchange rate, the NTD went somewhat weaker due to the relatively weaker RMB due to the increasing tensions between China and the US. The NTD/USD stood at 30.032 in late May 2020 indicating a 0.77% depreciation. Regarding the interest rate, it remained low and steady in May 2020 due to the continued loose monetary operations by the CBC with respect to the most recent CPI reading; the lowest and highest over-night call rate in May 2020 stood at 0.072% and 0.084% respectively.

Business Outlook

The portion of manufacturing firms who perceived business were better than expected in the target month was 22.5% or increased by 1.8 percentage points compared with respondents who perceiving better business in the previous month. The portion of those perceived business were getting worse in the target month was 37.9% or decreased by 15.2 percentage points than 53.1% perceiving worse business of the previous month. The portion of manufacturing firms who perceived business remained constant in the target month was 39.6% or increased by 13.4 percentage points compared with 26.2% perceiving constant business in the previous month. Overall, manufacturing firms perceived the business in the target month was somewhat optimistic than the previous month.

In addition, the portion of manufacturers who perceived business would be better in the next six months was 38.1% in the target month or increased by 15.1 percentage points than 23.0% feeling more optimistic about the future in the previous month. The portion of firms who perceived the economic outlook would be worsening was 22.0% or decreased also by 14.5 percentage points compared with 36.5% feeling rather pessimistic about the future in the previous month. The portion of manufacturing firms who perceived business remained constant in the next six months stood at 39.9% or decreased by 0.6 percentage points compared with 40.5% feeling neutral about the business outlook one month earlier. Overall, manufacturing firms perceived the business in the near future was also optimistic compared with the previous month.

The manufacturing composite indicator for May 2020 adjusted for seasonal factors on moving average, saw an upward correction, and from a revision of as 81.51 points in April 2020 moved up to 85.73 points. Figure 1 shows an increase of 4.22 points, the first increase after fourth-month consecutive decrease.

The TIER service sector composite indicator for May 2020 adjusted for seasonal factors on moving average also saw an upward correlation, and from a revision of as 82.81 points in April 2020 moved up to 89.68 points. Figure 1 shows an increase of 6.87 points, the second mount consecutive increase.

In addition, the TIER Construction Sector Composite Indicator for the seasonal factors on moving average saw an upward correlation as well, and from a revision of 84.27 points in April 2020 went up to 94.26 points. Figure 1 shows an increase of 9.99 points, the first increase after fourth-month consecutive decrease.

Forecast on Individual Industries

Following are manufacturers' sentiments that are industry-specific in the monthly TIER surveys:

● Manufacturers' sentiments that have been in decline in the May survey and are expected to deteriorate over the next six months include:

Wood and Bamboo Products Manufacturing, Printing, Plastics and Rubber Raw Materials, Porcelain and Ceramic Products Manufacturing, Iron and Steel Basic Industries, Fabricated Metal Products Manufacturing, Metal Dies, Screw, Nut Manufacturing, Machinery and Equipment Manufacturing and Repairing, Cutlery and Tools Manufacturing, Industrial Machinery, Restaurants and Hotels.

● Manufacturers' sentiments that have been in decline in the May survey, but are expected to improve over the next six months include:

Paper Manufacturing, Real Estate Investment.

● Manufacturers' sentiments that have been in decline in the May survey and are expected to remain sluggish over the next six months include:

Edible Oil Manufacturing, Flour Milling and Grain Husking, Soft Drink Manufacturing, Prepared Animal Feeds Manufacturing, Chemical Products Manufacturing, Plastic Products Manufacturing, Metal Structure and Architectural Components Manufacturing, Electronic Parts and Components Manufacturing, Motorcycles Manufacturing, Precision Instruments Manufacturing, Education and Entertainment Articles Manufacturing, Transportation and Storage.

● Manufacturers surveyed who felt the May outlook was the same as the previous month, but the outlook is expected to exacerbate over the next six months include:

Industrial Chemicals, Petrochemicals Manufacturing, Glass and Glass Products Manufacturing, Telecommunication Services.

● Manufacturers surveyed who felt the May outlook was the same as the previous month, but the outlook is expected to improve over the next six months include:

Leather, Fur and Allied Product Manufacturing, Cement and Cement Products Manufacturing, Audio and Video Electronic Products Manufacturing, Construction, Basic Civil Structure Construction.

● Manufacturers surveyed who felt the May outlook was the same as the previous month and the trend is expected to continue for the next six months include:

Manufacturing, Food, Slaughtering, Frozen Food Manufacturing, Textiles Mills, Yarn Spinning Mills, Fabric Mills, Apparel, Clothing Accessories and Other Textile Product Manufacturing, Man-made Fibers Manufacturing, Non-metallic Mineral Products Manufacturing, Electric Wires and Cables Manufacturing, Electronic Machinery, Communications Equipment and Apparatus Manufacturing, Motor Parts Manufacturing, Wholesale, Banks, Securities.

● Manufacturers' sentiments that have improved in the May survey and is expected to deteriorate over the next six months include:

Petroleum and Coal Products Manufacturing, Rubber Products Manufacturing.

● Manufacturers' sentiments that have improved in the May survey and is expected to remain upbeat over the next six months include:

Electrical Appliances and Housewares Manufacturing, Motor Vehicles Manufacturing, Bicycles Manufacturing, Bicycles Parts Manufacturing, Retail Sales.

● Manufacturers' sentiments that have improved in the May survey and the trend is expected to continue for the next six months include:

Electrical Machinery, Electrical Machinery, Supplies Manufacturing and Repairing, Data Storage Media Units Manufacturing and Reproducing, Transport Equipment Manufacturing and Repairing, Motorcycles Parts Manufacturing, Insurance.

|